Time Series Forecasting: Predicting Future Trends

The Power of Time Series Forecasting

Time series forecasting is a powerful analytical technique used to predict future values based on historical data patterns. From financial markets and sales forecasting to weather prediction and demand forecasting, time series forecasting helps businesses and organizations anticipate future trends and make informed decisions. In this article, we'll delve into the principles of time series forecasting and explore its applications across various domains.

Understanding Time Series Data

Time series data consists of observations recorded over successive time intervals, such as hourly, daily, monthly, or yearly. Each data point in a time series is associated with a timestamp, allowing analysts to analyze trends and patterns over time.

Example: Stock Prices

Stock prices represent a classic example of time series data, where the value of a stock is recorded at regular intervals (e.g., daily closing prices) over time. Analysts use time series forecasting techniques to predict future stock prices based on historical price movements.

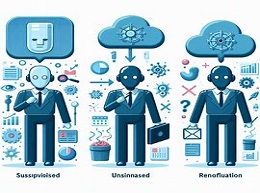

Types of Time Series Forecasting Models

There are several types of time series forecasting models, each suited to different types of data and forecasting tasks. Common models include:

1. Autoregressive Integrated Moving Average (ARIMA)

- ARIMA models are suitable for stationary time series data and can capture linear dependencies and trends in the data.

2. Exponential Smoothing Methods

- Exponential smoothing methods, such as simple exponential smoothing and Holt-Winters method, are effective for forecasting data with trend and seasonality components.

3. Long Short-Term Memory (LSTM) Networks

- LSTM networks, a type of recurrent neural network (RNN), are well-suited for modeling complex temporal dependencies in sequential data and are commonly used in time series forecasting tasks.

Applications of Time Series Forecasting

Time series forecasting finds applications across various industries and domains, including:

1. Financial Forecasting

- In finance, time series forecasting is used to predict stock prices, exchange rates, interest rates, and other financial indicators to inform investment decisions and risk management strategies.

2. Sales and Demand Forecasting

- Retailers and manufacturers use time series forecasting to predict sales volumes, demand for products, and inventory levels, optimizing supply chain management and production planning.

3. Weather Prediction

- Meteorologists use time series forecasting to predict weather patterns, such as temperature, precipitation, and wind speed, enabling early warnings for severe weather events and disaster preparedness.

Time Series Forecasting Techniques

Several techniques and approaches are used in time series forecasting, including:

1. Seasonal Decomposition

- Seasonal decomposition techniques, such as seasonal-trend decomposition using LOESS (STL), decompose time series data into trend, seasonal, and residual components, enabling separate modeling and forecasting of each component.

2. Feature Engineering

- Feature engineering involves extracting informative features from time series data, such as lagged values, moving averages, and seasonal indicators, to improve the performance of forecasting models.

3. Model Evaluation and Selection

- Model evaluation techniques, such as cross-validation and out-of-sample testing, are used to assess the accuracy and reliability of time series forecasting models and select the best-performing model for deployment.

Challenges and Considerations

While time series forecasting offers valuable insights for decision-making, it also presents challenges and considerations, including:

1. Data Quality and Preprocessing

- Ensuring data quality and preprocessing time series data, such as handling missing values, outliers, and irregularities, is essential for building accurate forecasting models.

2. Seasonality and Trends

- Accounting for seasonality, trends, and other temporal patterns in the data is critical for capturing and modeling the underlying dynamics of the time series accurately.

3. Model Complexity and Interpretability

- Balancing model complexity and interpretability is important in time series forecasting, as overly complex models may overfit the data, while overly simple models may fail to capture important patterns.

Leveraging Time Series Forecasting for Insights

Time series forecasting is a powerful tool for anticipating future trends and making informed decisions across various domains. By analyzing historical data patterns and leveraging advanced forecasting models and techniques, businesses and organizations can gain valuable insights into future outcomes, optimize resource allocation, and mitigate risks. As technology continues to advance and data availability increases, the role of time series forecasting in shaping the future of decision-making will only continue to grow, offering new opportunities for innovation and discovery.